The fiscal year budget deficit surged passed $1 trillion last month. Spending deficits necessarily mean more government borrowing and we’re seeing that in the numbers as well. Uncle Sam’s outstanding public debt grew by $450 billion in August alone.

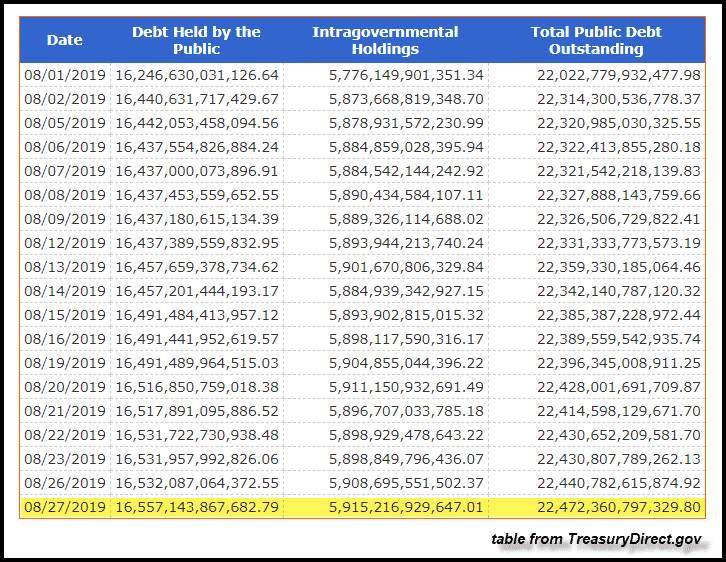

The national debt stood at $22.02 trillion on Aug. 1 and surged to $22.47 trillion as of Aug. 27.

As SRSrocco noted, the huge jump in the debt in August was partly due to the U.S.Treasury making up for lost time. The debt ceiling put a crimp on federal government borrowing earlier in the year until the bipartisan budget deal reached in July suspended the borrowing limit for two years.

This was the same deal – signed by President Trump – that will increase discretionary spending from $1.32 trillion in the current fiscal year to $1.37 trillion in fiscal 2020 and then raises it again to $1.375 trillion the year after that. The deal will allow for an increase in both domestic and military spending. So, the spending train keeps right on rolling.

Maybe Trump should change his slogan to “Make America Broke Some More.”

With the deal in place, the US Treasury announced it would issue $814 billion in new debt between August and December.

It’s certainly off to a solid start toward that goal.

Last February, the national debt topped $22 trillion. When President Trump took office in January 2017, the debt was at $19.95 trillion. That represented a $2.06 trillion increase in the debt in just over two years. The borrowing pace continues to accelerate, with the Treasury set to borrow over three-quarters of a trillion more in just six months. (If you’re wondering how the debt can grow by a larger number than the annual deficit, economist Mark Brandly explains here.)

The pundits in the mainstream media tend to focus on the Trump tax cuts as the cause for the surging deficits and growing national debt, but revenues are actually up. Trump spending is the real culprit.

For the fiscal year (beginning Oct. 1), the Trump administration has spent $4.16 trillion. That’s up 7 percent over last year. Uncle Sam has already spent more this year than it did in the totality of FY 2018.

This is one underlying reason that the Federal Reserve will almost certainly continue efforts to push interest rates lower. The federal government cannot sustain this kind of spending in a high interest rate environment. So far this year, Uncle Same has spent $379 billion simply paying interest on the existing debt. Imagine what that number would look like in anything approaching a normal interest rate environment.

The out of control spending and spiraling deficits are concerning enough on their own terms, but they become absolutely horrifying when you consider that these budget shortfalls are happening during an economic expansion. You would normally expect numbers like this during a major recession.

That raises an important question: what’s going to happen when the recession hits?

Democrats will point fingers at Trump. Republicans will blame Obama, or make some similarly lame excuse. The truth is, they are all responsible. Every modern administration – both Republican and Democrat, have borrowed and spent us into oblivion. Unconstitutional federal actions cost a lot of money – whether it’s spending for the welfare state or the warfare state. The real question is who is going to stop it?

- 1761: When American Independence was Born - February 13, 2026

- Writs, Riots, and Redcoats: Hancock’s Spark of the Revolution - January 17, 2026

- The National Bank That Breached the Articles of Confederation - June 2, 2025