Over the last few years, the Tenth Amendment Center has been covering state efforts that chip away at the Federal Reserve’s monopoly on money by facilitating and encouraging the use of gold and silver. The Federal Reserve’s influence goes far beyond the economy. Its existence facilitates the actions of the bloated, unconstitutional federal government we have today. Without the Fed lending it money and creating dollars out of thin air, the federal government couldn’t operate as it does today.

As Ron Paul said during an event after his Senate committee testimony in favor of an Arizona bill repealing the state’s capital gains taxes on gold and silver, dealing with the Fed is really about the size and scope of government.

“If you’re for less government, you want sound money. The people who want big government, they don’t want sound money. They want to deceive you and commit fraud. They want to print the money. They want a monopoly. They want to get you conditioned, as our schools have conditioned us, to the point where deficits don’t matter.”

I originally wrote the following article for SchiffGold. It reveals just how much impact the Federal Reserve has and why it’s so important to end its monopoly on money.

Could we be on the verge of a retail apocalypse?

February marked the third straight month of declining retail sales. Analysts had not expected another drop, but they got one nonetheless. Sales fell 0.1% in February. Analysts had expected an uptick of 0.3%.

This is not good news for a retail sector that is already teetering on the brink.

This month, we also got word that Toys R Us plans to close all of its stores. The giant toy retailer announced bankruptcy last fall. The TRU filing ranks as the second-largest US retail bankruptcy ever. Toys R Us had $6.6 billion in assets at the time of filing. Only Kmart was bigger. It had $16.3 billion in assets when it went bankrupt in 2002.

Toys R Us is the most visible proof that the air is rushing out of the retail bubble.

It’s easy to finger-point at the Amazon and blame it for the black cloud enveloping the brick and mortar retail sector. In fact, online sales didn’t kill Geoffery the giraffe. Massive corporate debt was the culprit. And massive corporate debt is endemic in the retail sector.

The story behind the Toys R Us bankruptcy gives us a glimpse at a fundamental problem eroding the strength of the US economy – easy money created by Federal Reserve monetary policy. The ability to borrow a lot of money at low interest rates fuels borrowing and speculation. Malinvestment distorts the economy and inflates bubbles that eventually pop.

Over the last 20 years, the Fed has inflated and maintained a giant retail bubble.

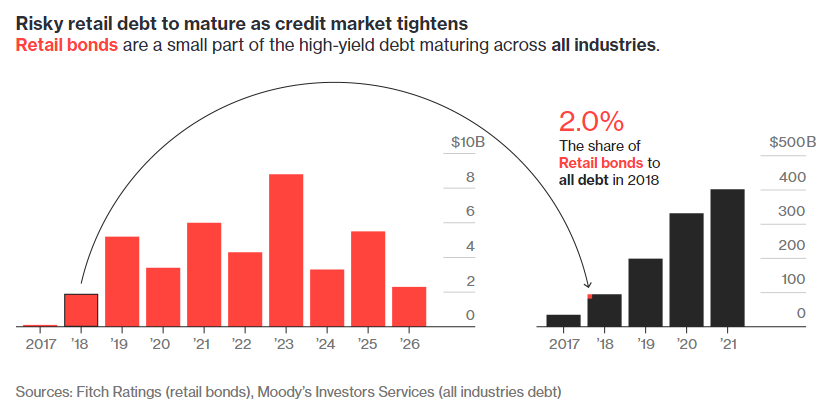

All of that debt is beginning to come due. In an in-depth report published last fall, Bloomberg reported that $1.9 billion in high-yield retail borrowing will come due in 2018, according to Fitch Ratings Inc. And from 2019 to 2025, the debt coming due will balloon to an annual average of almost $5 billion.

“The amount of retail debt considered risky is also rising. Over the past year, high-yield bonds outstanding gained 20 percent, to $35 billion, and the industry’s leveraged loans are up 15 percent, to $152 billion, according to Bloomberg data. Even worse, this will hit as a record $1 trillion in high-yield debt for all industries comes due over the next five years, according to Moody’s. The surge in demand for refinancing is also likely to come just as credit markets tighten and become much less accommodating to distressed borrowers.”

This is all happening as the Federal Reserve is pushing to “normalize” interest rates. In other words, these over-leveraged retailers can no longer just kick the can down the road by refinancing their debt at low interest rates. The amount of debt coming due coupled with a tightening borrowing environment is a perfect storm for struggling retailers. Bloomberg summed it up.

“Retailers have pushed off a reckoning because interest rates have been historically low from all the money the Federal Reserve has pumped into the economy since the financial crisis. That’s made investing in riskier debt—and the higher return it brings—more attractive. But with the Fed now raising rates, that demand will soften. That may leave many chains struggling to refinance, especially with the bearishness on retail only increasing.”

The retail bubble began to inflate in the 1990s and early 2000s along with the dot-com bubble. Hundreds of stores opened. Monetary policy helped keep the bubble inflated. Toys R Us ran up its massive debt during the low interest rate years following the dot-com collapse. The Federal Reserve has held interest rates low for nearly a decade and engaged in other monetary policies meant to stimulate consumption. The goal? Keep consumers spending money. It’s worked. Americans opened their pocketbooks and kept the retail blimp afloat.

But America is tapping the brakes. Retail sales are dropping off. What gives?

Pundits and government talking heads keep telling us the economy is great. Employment is up. Stocks are up. Americans just got tax cuts that put more cash in their pockets. These are all ingredients for a retail boom. Yet more retail chains are filing for bankruptcy and are rated distressed than during the financial crisis. As Peter Schiff noted in a podcast last week, this raises an important question.

“So why didn’t any of those million people take their paychecks and spend them at a retailer? I mean, Trump is talking about all the great jobs, and all the raises that people have, and all the tax cuts. Why are retail sales down for three months in a row?”

The bottom line is Americans are broke.

Household debt has surged to record levels. Americans have maxed out the credit cards.

The thrust of the Bloomberg report was that the retail apocalypse will ripple through the entire economy.

The debt coming due, along with America’s over-stored suburbs and the continued gains of online shopping, has all the makings of a disaster. The spillover will likely flow far and wide across the US economy. There will be displaced low-income workers, shrinking local tax bases and investor losses on stocks, bonds and real estate. If today is considered a retail apocalypse, then what’s coming next could truly be scary.”

Consumer spending accounts for something like 60% of GDP. Broke people don’t spend money.

And all of these great jobs reports will vanish like a vapor as retail companies go under. About 31,000 Americans will hit the unemployment line when Toys R Us finishes shuttering its stores this year. As Bloomberg pointed out, “The ripple effect could also be a direct hit to the industry that is the largest employer of Americans at the low end of the income scale. The most recent government statistics show that salespeople and cashiers in the industry total 8 million.”

During the financial crisis, 1.2 million storeworkers lost their jobs.

The mainstream is still convinced the economy is great. But the Fed poured a foundation with defective concrete. Now it’s starting to crack and crumble. It is eventually going to cave in. It’s just a matter of time.

- Utah’s Step-By-Step Strategy in Support of Sound Money - April 9, 2024

- Utah’s Step-By-Step Strategy Against the Surveillance State - April 1, 2024

- How the Federal Reserve Backstops the Biggest Government in History - February 21, 2024