The Trump administration has added more than $7 trillion to the national debt – in less than four years.

The national debt surged above $27 trillion on Oct. 1. It barely even got a mention in the mainstream media.

The U.S. government has added over $3 trillion to the national debt this year alone and there is no sign that the borrowing and spending will stop. In fact, Trump, along with congressional leadership on both sides of the aisle, want to spend more. They just can’t agree on exactly how much to spend or what exactly to spend it on.

Most people blame the coronavirus pandemic for the surging debt. But the Trump administration was running up massive deficits before COVID-19 reared its ugly head. It simply continued and accelerated the spending problem inherited from the Obama administration. The truth is the federal government was spending as if there was a major economic crisis before the current economic crisis.

The proof is in the numbers.

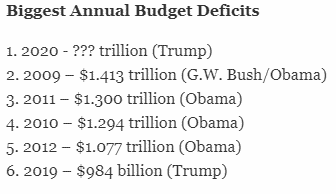

In fiscal 2019, the Trump administration ran the fifth-biggest deficit in history. Through the first two months of fiscal 2020, the deficit was already 12 percent over 2019’s huge Obama-like number and was on track to eclipse $1 trillion. Prior to 2020, the U.S. government had only run deficits over $1 trillion four times, all during the Great Recession. We were approaching that number prior to the pandemic, despite what Trump kept calling “the greatest economy in the history of America.”

When Trump moved into the White House in January 2017, the debt stood at $19.95 trillion. It topped $22 trillion in February 2019. That represented a $2.06 trillion increase in the debt in just over two years. By November 2019, the debt had eclipsed $23 trillion. Trump, in cooperation with Pelosi, has already added well over $3 trillion to that number this year alone putting the total Trump-era debt over $7 trillion with several months to go.

The debt-to-GDP ratio currently stands at 137.73 percent. Despite the lack of concern in the mainstream, debt has consequences. Studies have shown that a debt to GDP ratio over 90 percent retards economic growth by about 30 percent. This throws cold water on the Republican mantra “we can grow ourselves out of the debt.”

According to a recent CBO report, on the current trajectory, the size of the national debt will be nearly double the size of the U.S. economy by 2050.

Despite the warning signs, nobody seems inclined to address the rising levels of debt. Even as the fiscal 2020 budget deficit surged past $3 trillion, more than double the previous record deficit, U.S. Treasury Secretary Steve Mnuchin called for more federal spending, saying “now is not the time to worry about shrinking the deficit.”

Here’s a question for Mr. Secretary: When exactly is the time to worry about it?

The Trump administration certainly wasn’t worried about it last year, even as the president was bragging about the greatest economy in history. So, if we don’t worry about the deficit during a crisis and we don’t worry about the deficit during a boom, when do we worry about it?

It’s easy to simply shrug off the debt. People have been warning about it for years. Here’s the thing: it’s not a problem until it is. Ultimately, debt is neither free nor is it irrelevant.

At some point, somebody has to pay for all this. As the saying goes – there’s no such thing as a free lunch.

Currently, the average American doesn’t really feel the impact of federal spending. Taxes remain low (relatively speaking). The Treasury simply borrows the money. But borrowed money has to be paid back. At some point, Congress will almost certainly raise taxes to pay the bill. And even if the government depends on the Federal Reserve to print money to pay the debt – we still pay through the virtually invisible inflation tax. In simple terms, the central bank devalues your money to pay the government’s bills.

Either way – we pay.

- Tench Coxe: Forgotten Federalist who Helped Influence Ratification of the Constitution - November 18, 2024

- States vs. Feds: The 10th Amendment Battle Over Conscription in the War of 1812 - November 15, 2024

- George Mason’s Anti-Federalist Arguments Against the Constitution - November 11, 2024