President Trump has repeatedly bragged about “his” economy, talking about economic growth in glowing, hyperbolic terms. To hear the president tell it (or tweet it as the case may be) Americans currently enjoy the best economy in the history of forever. But Trump’s boasting doesn’t hold up, even to a cursory examination of the data.

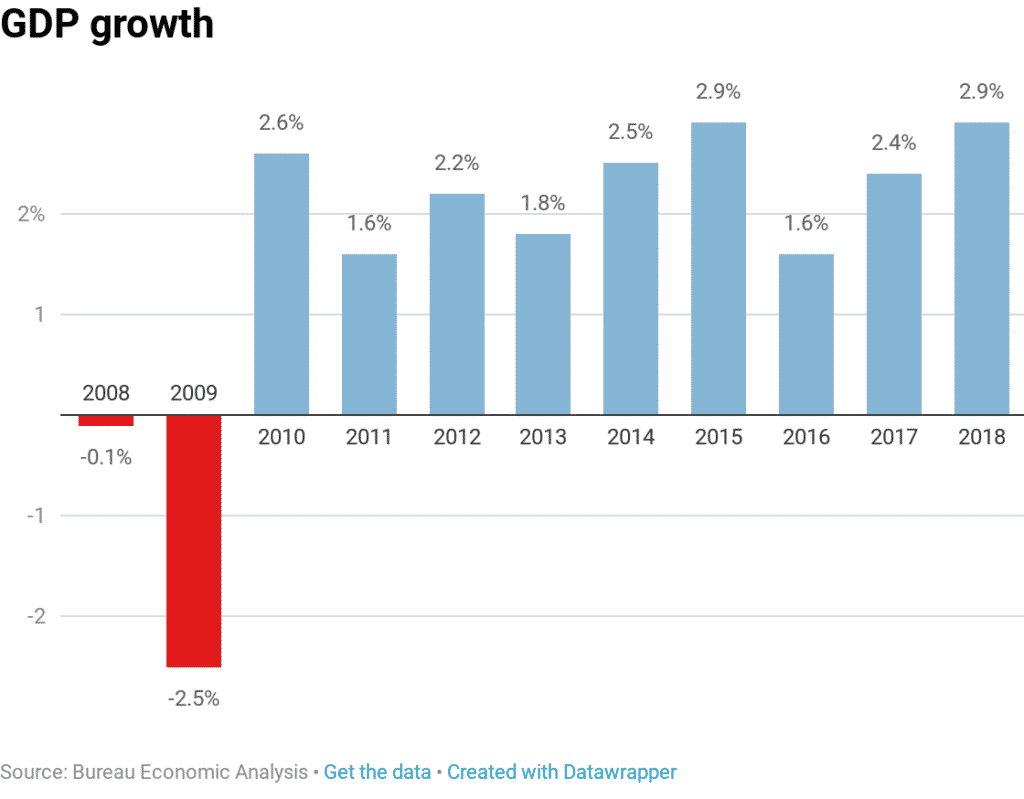

Economic growth over the last two years, as measured by GDP, comes in at basically the same rate as it did during the best two years of the Obama administration.

And if you dig deeper into the numbers, you will find that it’s all smoke and mirrors. The entire economy is nothing but a house of cards built on a shaky foundation of spending and debt.

The Commerce Department recently released second-quarter GDP data. Although it slightly beat expectations, growth came in at a relatively tepid 2.1 percent.

Along with releasing Q2 data, the Commerce Department also revised numbers from previous quarters. As it turns out, the economy actually grew slightly faster during Obama’s two best years (2014 and 2015) than it has during the first two years of the Trump administration.

The best year for GDP growth during the Obama era was 2015 when the economy grew by 2.9 percent. That’s identical to the 2.9 percent growth in 2018. In 2014, GDP was 2.5 percent. That compares with 2.4 percent in Trump’s first year.

In a nutshell, the data reveals very little difference between the Trump and Obama economies.

Nevertheless, Trump wasn’t discouraged about the lackluster Q2 number. He tweeted that growth was “not bad considering we have the very heavy weight of the Federal Reserve anchor wrapped around our neck.”

Q2 GDP Up 2.1% Not bad considering we have the very heavy weight of the Federal Reserve anchor wrapped around our neck. Almost no inflation. USA is set to Zoom!

— Donald J. Trump (@realDonaldTrump) July 26, 2019

Trump’s tweet actually misses the truth by about 180 degrees.

The Federal Reserve has certainly had a major impact on the economy, but not in the way Trump would have you believe. In fact, the Fed’s easy money policy with its low interest rates have driven what little economic growth we’ve seen. Federal Reserve policy isn’t a millstone wrapped around the economy’s neck. It’s a hydraulic jack propping it up.

The Fed cut interest rates to zero in the wake of the 2008 crash and held them there for seven years. In December 2015, the central bank began to “normalize” rates. But it only managed to push rates to 2.5 percent (nowhere near “normal”) before the stock market began to tank in December 2018. To stop the air from coming out of the bubble, the Fed put normalization on hold. Powell and company are now set to begin cutting rates again.

These abnormally low interest rates were intended to “stimulate” the economy by incentivizing borrowing and spending. It certainly worked, as the most recent GDP report reveals.

The most important part of GDP – gross private domestic investment – was down 5.5 percent in Q2. That represents the weakest quarter since Q4 2015. Non-residential business investment was also down 0.6 percent. Residential investment fell 1.5 percent. That category has been down six straight quarters, the longest span since 2009 — during the Great Recession. Net exports saw the biggest drop in a decade last quarter.

In a nutshell, the economy supposedly grew by 2.1 percent, despite a decline in business investment, decreasing imports and falling corporate profits.

So, what drove the growth?

Borrowed money.

Consumer spending increased by 4.3 percent and accounted for nearly all of the GDP growth. That may lead you to believe that the U.S. workers have plenty of money in their pockets.

You would believe wrong.

Consumers are digging deeper and deeper into debt to pay for this spending spree. Consumer debt has risen to a record-setting $4.9 trillion. That does not include mortgages. Americans owe over $1.07 trillion in credit card debt. Credit card balances rose by $7.2 billion in May alone.

The other big boost to GDP in Q2 came in the form of government stimulus. Federal spending was up 5 percent. That added 0.85 percent to the overall GDP. Non-defense spending was up a whopping 15.9 percent in Q2. The last time government spending grew that much in a single quarter was 21 years ago. The U.S. endured two recessions in that timespan – including the Great Recession.

In other words, government spending rose last quarter by more than it did in any quarter during either of those recessions. Think about that. Trump keeps complaining that he’s not getting as much monetary stimulus via low interest rates as Obama did. But he’s getting more fiscal stimulus.

When you shatter the mirrors and blow away the smoke, you discover the truth about the supposed success of the Trump economy (and the Obama economy too for that matter) — it has nothing to do with industry or business. The consumer and the federal government spent more borrowed money.

That’s it.

The raises the $22 trillion question. How long can an economy built on debt continue to grow?

- Thomas Jefferson’s Warnings and Predictions about the Dangers of Money-Printing - April 18, 2024

- Utah’s Step-By-Step Strategy in Support of Sound Money - April 9, 2024

- Utah’s Step-By-Step Strategy Against the Surveillance State - April 1, 2024