We generally call it Obamacare, but the official name for the legislation that created the government insurance scheme was The Affordable Care Act. That sounds good, right? We all want affordable. Except that it isn’t.

I have found other alternatives to deal with health coverage, but just out of curiosity, I went through the federal insurance exchange (Healthcare.gov) to see what traditional insurance would cost my wife and me in 2019.

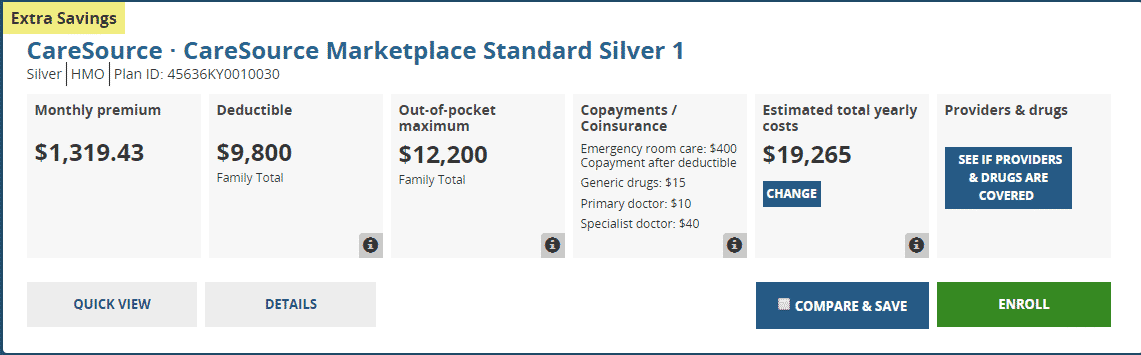

Here are the results.

I’d hate to see how much the unaffordable version would be.

It’s important to note that since my wife and I are both self-employed, the only way to get health insurance is through the exchange. You can go through a private company, but ultimately, they just work through the exchange. No other options exist.

Kentuckians can chose from basically two companies. The photo shows the plan that we would most like choose based on coverages and costs. It’s essentially the same plan we had in 2017. At that time, it cost about $650 per month. It is the most “affordable” option that would provide any meaningful coverage. I put affordable in quotes because it’s not. We don’t qualify for any tax credits.

By the way – none of my doctors take this insurance.

Here’s what Obamacare has actually done. It has made it possible for people on the very bottom to get health insurance, but it’s made it impossible for people like us. All it did was push the problem a little higher up the economic ladder. It’s done nothing to address costs – as evidenced by a 100% premium increase in just 2 years. The system is absurd.

Fortunately, there are free-market alternatives (as free market as you can get in the highly regulated and government controlled mess we currently have) that offer substantial cost savings. At least for the time being.

We’ve been covering the movement to facilitate “direct primary care” practices at the state level.

According to Michigan Capitol Confidential, by removing a third party payer from the equation, medical retainer agreements help both physicians and patients minimize costs. Jack Spencer writes:

“Under medical retainer agreements, patients make monthly payments to a physician who in return agrees to provide a menu of routine services at no extra charge. Because no insurance company stands between patient and doctor, the hassles and expense of bureaucratic red tape are eliminated, which have resulted in dramatic cost reductions. Routine primary care services (and the bureaucracy required to reimburse them) are estimated to consume 40 cents out of every dollar spent on insurance policies, so lower premiums for a given amount of coverage are another potential benefit.”

I have firsthand experience with this model as a member of a direct primary care practice.

I pay $75 a month flat fee. That covers anything that happens within the office. For example, just yesterday, I had a cyst that had become abscessed. I called at 9:30 a.m. At 10:30 a.m., I was in the waiting room. At 10:32, I was taken back. By 10:37, I was talking to the doctor. Try that at your local doctor’s office. The doc performed what was essentially minor surgery. What did it cost me? A few dollars for an antibiotic prescription that was filled in the office. This experience with my old doctor would have cost been billed to an insurance company at an amount almost certainly over $1,000. I would have paid a $40 copay, plus whatever the retail cost of the prescription — and in all likelihood the entire bill as I would not have reached my $9,000 deductible. By the way, getting my monthly meds through my DPC provider saves me $50 a month. So, in effect, I’m paying them $25 a month net for unlimited primary care services. They have also negotiated extremely low costs for lab work and diagnostic test. I had to have an x-ray a couple of months back. It cost me less than $100. Bloodwork costs a few dollars.

So, yes, there are ways to controls costs when you get outside of the absurd insurance system. Why in the hell are we inuring basic, routine healthcare? It’s like getting auto insurance for an oil change. That’s not what insurance is for.

This whole thing is designed to push us into a single-payer system. Because, you know, the government has a great track record at that. Medicare is bankrupt. Trustees project the program’s hospital insurance fund will run out of money in 2026.

I look forward to finding my black market healthcare alternatives in the future.

- Tench Coxe: Forgotten Federalist who Helped Influence Ratification of the Constitution - November 18, 2024

- States vs. Feds: The 10th Amendment Battle Over Conscription in the War of 1812 - November 15, 2024

- George Mason’s Anti-Federalist Arguments Against the Constitution - November 11, 2024